Proposed Privatisation

PROPOSED PRIVATISATION OF PARAGON REIT

BY WAY OF A TRUST SCHEME OF ARRANGEMENT

On 11 February 2025, the respective boards of directors of the Paragon Manager and TPPL jointly announced the privatisation of PARAGON REIT, which shall be effected through the acquisition by TPPL of all the Units held by the Minority Unitholders, by way of a Scheme in compliance with the Code and the Paragon Trust Deed, as may be amended, supplemented or varied from time to time (including as may be amended by the Paragon Trust Deed Amendments).

On 27 March 2025, the Paragon Manager disseminated to Unitholders a scheme document (the "Scheme Document") dated 27 March 2025 by electronic means.

Copies of the Joint Announcement and the Scheme Document are available on SGXNET at https://www.sgx.com/securities/company-announcements. Should you wish to receive a printed copy of the Scheme Document, please complete the Request Form.

KEY DATES/DEADLINES

The table below sets out the key dates/deadlines for Unitholders and persons (including CPFIS Investors and SRS Investors) who hold Units through relevant intermediaries to note:

- Key Dates/Deadlines

Key Dates Actions Dialogue Session 4 April 2025, 5.00 p.m. Dialogue Session Registration Deadline: Registration Deadline for Unitholders and persons (including CPFIS Investors and SRS Investors) who hold Units through relevant intermediaries to pre-register for the Dialogue Session at the website www.sias.org.sg/paragonreit. 4 April 2025, 5.00 p.m. Dialogue Session Questions Deadline: Deadline for Unitholders and persons (including CPFIS Investors and SRS Investors) who hold Units through relevant intermediaries to submit all substantial and relevant questions related to the resolutions to be tabled for approval at the EGM and/or the Scheme Meeting in advance of the Dialogue Session, in order for the Paragon Manager to be able to respond to such substantial and relevant questions at the Dialogue Session (either via the pre-registration website for the Dialogue Session at www.sias.org.sg/paragonreit, via e-mail to the Paragon Manager at ir@paragonreit.com.sg or by post to the office of the Unit Registrar, Boardroom Corporate & Advisory Services Pte. Ltd. at 1 Harbourfront Avenue, Keppel Bay Tower #14-07, Singapore 098632). 6 April 2025, 5.00 p.m. Dialogue Session Confirmation E-mail: Authenticated Unitholders and persons (including CPFIS Investors and SRS Investors) who hold Units through relevant intermediaries will receive a confirmation e-mail to attend the Dialogue Session in person.

Unitholders and persons (including CPFIS Investors and SRS Investors) who hold Units through relevant intermediaries who do not receive any confirmation e-mail by 5.00 p.m. on 6 April 2025 but have registered by the Registration Deadline should contact SIAS via e-mail at admin@sias.org.sg.7 April 2025, 7.00 p.m. Dialogue Session: Dialogue Session held by the Paragon Manager in conjunction with SIAS at Lifelong Learning Institute, Lecture Theatre, Level 2, 11 Eunos Road 8, Singapore 408601. EGM and Scheme Meeting 10 April 2025, 5.00 p.m. Deadline for CPFIS Investors and SRS Investors to contact CPF Agent Banks and SRS Agent Banks: Deadline for CPFIS Investors and SRS Investors who wish to participate in and/or vote at the EGM and/or the Scheme Meeting (as the case may be) to approach their respective CPF Agent Banks or SRS Agent Banks. 14 April 2025, 5.00 p.m. Deadline for Submission of Request Form: Deadline for Unitholders (including Overseas Unitholders) who wish to obtain printed copies of the Scheme Document to complete and return the Request Form (either via e-mail to srs.requestform@boardroomlimited.com or by post to the office of Boardroom Corporate & Advisory Services Pte. Ltd. at 1 Harbourfront Avenue, Keppel Bay Tower #14-07, Singapore 098632). 15 April 2025, 2.30 p.m. Deadline for Submission of Questions in advance of the EGM and the Scheme Meeting: Deadline for Unitholders and persons (including CPFIS Investors and SRS Investors) who hold Units through relevant intermediaries to submit all substantial and relevant questions related to the resolutions to be tabled for approval at the EGM and/or the Scheme Meeting in advance of the EGM and/or the Scheme Meeting, respectively (either via e-mail to the Paragon Manager at ir@paragonreit.com.sg or by post to the office of the Unit Registrar, Boardroom Corporate & Advisory Services Pte. Ltd. at 1 Harbourfront Avenue, Keppel Bay Tower #14-07, Singapore 098632). 17 April 2025, 2.30 p.m. Responses to Substantial and Relevant Questions: The Paragon Manager will endeavour to address all substantial and relevant questions received in advance of the EGM and/or the Scheme Meeting and the responses will be posted on SGXNet and the corporate website of PARAGON REIT. Where substantially similar questions are received, the Paragon Manager will consolidate such questions and consequently not all questions may be individually addressed. 19 April 2025, 2.30 p.m. Deadline for Submission of Proxy Form A (EGM): Deadline for Unitholders to submit the Proxy Form A (EGM) (either via e-mail to srs.proxy@boardroomlimited.com or by post to the office of Boardroom Corporate & Advisory Services Pte. Ltd. at 1 Harbourfront Avenue, Keppel Bay Tower #14-07, Singapore 098632). 19 April 2025, 3.00 p.m. Deadline for Submission of Proxy Form B (Scheme Meeting): Deadline for Unitholders to submit the Proxy Form B (Scheme Meeting) (either via e-mail to srs.proxy@boardroomlimited.com or by post to the office of Boardroom Corporate & Advisory Services Pte. Ltd. at 1 Harbourfront Avenue, Keppel Bay Tower #14-07, Singapore 098632). 22 April 2025, 2.30 p.m. EGM: The EGM will be held at Simpor Junior Ballroom, Level 4, Sands Expo & Convention Centre, 10 Bayfront Avenue, Singapore 018956 to approve the Paragon Trust Deed Amendments Resolution. 22 April 2025, 3.00 p.m. (or as soon as thereafter following the conclusion of the EGM) Scheme Meeting: If the Paragon Trust Deed Amendments Resolution is passed by way of an Extraordinary Resolution at the EGM, the Scheme Meeting will be held at Simpor Junior Ballroom, Level 4, Sands Expo & Convention Centre, 10 Bayfront Avenue, Singapore 018956 to approve the Paragon Scheme Resolution.

FREQUENTLY ASKED QUESTIONS

You may have some questions on the Scheme Document. Please refer to the following list of questions and responses for further information. The information contained herein should be read in conjunction with, and in the context of the Joint Announcement and the Scheme Document.

Unitholders of PARAGON REIT (“Unitholders”) are reminded to consider the Joint Announcement and Scheme Document in its entirety. As each Unitholder would have different investment objectives and profiles, any individual Unitholder who may require advice in the context of his/her/its specific investment objectives or portfolio should consult his/her/its stockbroker, bank manager, solicitor, accountant, tax adviser or other professional adviser immediately. Unless otherwise stated, terms and references used but not defined in this FAQ shall have the same meaning as that set out in the Joint Announcement.

- What is this transaction about and why is it happening? Who is the Offeror?

- The Offeror and the Paragon Manager, the manager of PARAGON REIT, have jointly announced the proposed privatisation of PARAGON REIT.

- The proposed privatisation is to be implemented by way of a trust scheme of arrangement (the “Scheme”) at a Scheme Consideration of S$0.9800 per Unit in cash.

- It is intended to pave the way for a potential significant asset enhancement initiative (“Potential AEI”) to future-proof Paragon and safeguard its status as a premier upscale landmark.

- The Offeror is a wholly-owned subsidiary of Cuscaden Peak Investments Private Limited. (“Sponsor”), which is the sponsor of PARAGON REIT.

- Collectively, the Sponsor and its subsidiaries (including the Offeror) hold a 61.5% stake in PARAGON REIT.

- What is the rationale for the transaction? Why is privatisation necessary to execute a Potential AEI?

- PARAGON REIT is constrained in its potential for sustained growth as it has faced low free float and trading liquidity, as well as limited analyst coverage and institutional investor flows, which restrict its ability to access capital markets and expand its portfolio, as compared to other retail S-REIT peers.

- PARAGON REIT’s portfolio also relies heavily on Paragon, a leading upscale mall that is more than 30 years old and that accounts for 72% of the REIT’s appraised value.

- However, Paragon’s premier upscale status is being challenged by malls undergoing major upgrades and upcoming redevelopments in the surrounding catchment, which are expected to significantly ramp up competition once completed, as well as a challenging luxury retail environment.

- As such, the Offeror believes that a major Potential AEI for Paragon is necessary to maintain its long-term competitiveness as a leading upscale retail mall in Singapore and intends to collaborate closely with PARAGON REIT to facilitate the implementation of such a Potential AEI.

- The Offeror envisions that future-proofing Paragon through a Potential AEI could require a sizeable capital investment, potentially taking three to four years to complete, and carrying significant execution risks such as barring cost and timing uncertainties.

- Given the execution risks of a Potential AEI, including uncertainties around cost and timing, as well as the potential impact on PARAGON REIT’s Net Property Income (“NPI”), distributable income and Distribution per Unit (“DPU”), a Potential AEI would be more suitably carried out in a private setting.

- If the Scheme is successful, Unitholders will not have to bear the volatility and risks associated with a major Potential AEI and will have the opportunity to realise their investment fully in cash at an attractive Scheme Consideration.

- How does the Scheme Consideration compare to PARAGON REIT’s valuation and other similar transactions?

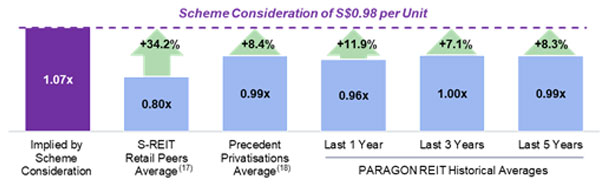

- The Scheme Consideration of S$0.9800 offers attractive value to Unitholders, based on the various metrics outlined below:

- Represents a 7.1% premium to PARAGON REIT’s adjusted NAV per Unit and an implied Price / Adjusted NAV of 1.07x; which represents a 8.4% premium to average Price / Adjusted NAV of precedent comparable privatisations1 of 0.99x;

- Implied Price / Adjusted NAV of 1.07x represents a premium of 34.2% to the average Price / Adjusted NAV of 0.80x of Singapore retail REITs;

Implied Price / Adjusted NAV of 1.07x represents a 11.9%, 7.1% and 8.3% premium to PARAGON REIT’s historical average 1-year, 3-year and 5-year Price / Adjusted NAV respectively;

Price / Adjusted NAV

Source: FactSet, Bloomberg, Company Filings as of 10 February 2025

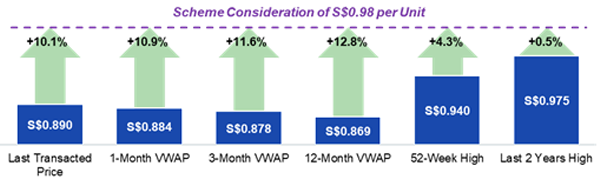

Represents a 10.1%, 10.9%, 11.6% and 12.8% premium to the Last Transacted Price and the one (1)-month, three (3)-month and 12-month volume weighted adjusted price, respectively;

- Exceeds the highest ever traded price over the last two years;

- Represents a 4.3% premium to the 52-week high traded price of PARAGON REIT Units;

- Represents a premium of 9.0 Singapore cents over the Last Transacted Price which translates to approximately two (2) years of distribution2.

- The Scheme Consideration of S$0.9800 offers attractive value to Unitholders, based on the various metrics outlined below:

- Will any adjustments be made to the Scheme Consideration for the 2H FY2024 distribution?

- The 2H FY2024 distribution of 2.33 Singapore cents per Unit was paid to Unitholders on 28 March 2025. The Scheme Consideration will not be reduced or otherwise adjusted for this amount.

- What will happen to PARAGON REIT if the Scheme fails?

- In the event that the Scheme is not approved by Unitholders, the Offeror intends to actively engage with PARAGON REIT to consider an appropriate plan for Paragon, as it strongly believes that a Potential AEI is critical for Paragon to remain competitive.

- Under the Singapore Code on Take-overs and Mergers, except with the consent of the Securities Industry Council, the Offeror is not permitted to make another takeover offer for PARAGON REIT for 12 months should the Scheme be unsuccessful.

- Who is the Independent Financial Adviser (IFA) appointed and what is their opinion in respect of the Scheme?

- PrimePartners Corporate Finance Pte. Ltd. was appointed as the independent financial adviser pursuant to Rule 1309(2) of the Listing Manual as well as to advise the Paragon Independent Directors and the Paragon Trustee on the terms of the Scheme, in compliance with the provisions of the Code.

- The IFA is of the view that the financial terms of the Scheme is FAIR and REASONABLE.

- The independent financial advice in relation to the Scheme is set out in the IFA Letter as set out in Appendix A of the Scheme Document. The IFA opinion should be considered in the context of the entirety of the IFA Letter and the Scheme Document.

- What is the recommendation by the Board of Directors?

- Acting in accordance with their fiduciary duties and upon extensive evaluation, the Board of Directors are of the view that the Scheme represents the most attractive and credible option available which, if it becomes effective, delivers immediate deal certainty (from a timing and execution perspective) to Unitholders, by allowing Unitholders to fully monetise their investment in their Units in cash at an attractive Scheme Consideration and the ability to redeploy their funds to other investments, if desired and are therefore proposing the Scheme for the consideration of the Unitholders.

- The Board of Directors have considered carefully the terms of the Scheme and the advice given by the IFA in the IFA Letter and recommend that Unitholders VOTE IN FAVOUR of the Paragon Scheme Resolution at the Scheme Meeting.

- As a Unitholder of PARAGON REIT, what should I do if I am in favour of the Scheme?

- You are encouraged to seek independent advice on your options with regards to your holdings in PARAGON REIT.

- As stated in the Scheme Document, the IFA is of the opinion that as of the Latest Practicable Date, from a financial point of view, the Scheme is fair and reasonable. Accordingly, the Independent Directors recommend that Unitholders vote in favour of the Scheme at the Scheme Meeting.

- Unitholders who are in favour of the Scheme should VOTE IN FAVOUR of the Scheme at the Scheme Meeting.

- Are there any costs for Unitholders if the Scheme becomes effective?

- There will be no brokerage costs incurred by Unitholders if the Scheme becomes effective.

- What is the approval threshold for the Scheme to be successful? What are the regulatory approvals required?

- The Scheme will require, inter alia, the following approvals:

- The approval of the Unitholders by way of an Extraordinary Resolution at the EGM to be convened to approve the Paragon Trust Deed Amendments;

- The approval of a majority in number of the Minority Unitholders representing at least three-fourths in value of the Units held by the Minority Unitholders present and voting either in person or by proxy at Scheme Meeting for the Paragon Scheme Resolution; and

- The scheme Court Order being obtained.

- When the Scheme, with or without modification, becomes effective, it will be binding on all Unitholders, whether or not they were present in person or by proxy or voted at the Scheme Meeting.

- The Scheme will require, inter alia, the following approvals:

- Who can I contact if I have any questions / require more information about the Scheme?

All investor enquiries relating to the Potential AEI, Scheme or the Scheme Document should be directed to one of the following:

Financial adviser to PARAGON REIT

Morgan Stanley Asia (Singapore) Pte.

Investment Banking

Telephone: +65 6834 7215Financial Adviser to the Offeror

Citigroup Global Markets Singapore Pte. Ltd.

Investment Banking

Telephone: +65 6657 8017Media Contacts

PR Adviser to PARAGON REIT

Teneo

Tok Chong Yap / Jonathan Yeoh

Email: paragonreit@teneo.com

Telephone: +65 6955 8873PR Adviser to Offeror

SEC Newgate Singapore

Karin Lai / Lynette Tan

Email: karin.lai@secnewgate.sg / lynette.tan@secnewgate.sg

Telephone: +65 6513 8300PARAGON REIT Investor Relations

Lee Hoong Chun

Head of Investor Relations

Email: ir@paragonreit.com.sg

Telephone: +65 6631 8987

Notes:

- Based on precedent privatisation of property trusts and REIT mergers with an all-cash option as consideration.

- Based on last twelve months distributions declared of 4.65 Singapore cents, excluding special dividends that are capital distributions in nature.

Responsibility Statements

TPPL. The directors of TPPL (including those who may have delegated detailed supervision of this FAQ) have taken all reasonable care to ensure that the facts stated and opinions expressed in this FAQ are fair and accurate and that there are no other material facts not contained in this FAQ, the omission of which would make any statement in this FAQ misleading. Subject to the paragraph below, the directors of TPPL jointly and severally accept responsibility accordingly.

Where any information has been extracted or reproduced from published or otherwise publicly available sources or obtained from a named source (including PARAGON REIT and/or the Paragon Manager), the sole responsibility of the directors of TPPL has been to ensure through reasonable enquiries that such information is accurately extracted from such sources or, as the case may be, reflected or reproduced in this FAQ. The directors of TPPL do not accept any responsibility for any information relating to PARAGON REIT and/or the Paragon Manager or any opinion expressed by PARAGON REIT and/or the Paragon Manager.

Paragon Manager. The directors of the Paragon Manager (including those who may have delegated detailed supervision of this FAQ) have taken all reasonable care to ensure that the facts stated and opinions expressed in this FAQ (excluding information relating to TPPL or any opinion expressed by TPPL) are fair and accurate and that there are no other material facts not contained in this FAQ, the omission of which would make any statement in this FAQ misleading. Subject to the paragraph below, the directors of the Paragon Manager jointly and severally accept responsibility accordingly.

Where any information has been extracted or reproduced from published or otherwise publicly available sources or obtained from a named source (including TPPL), the sole responsibility of the directors of the Paragon Manager has been to ensure through reasonable enquiries that such information is accurately extracted from such sources or, as the case may be, reflected or reproduced in this FAQ. The directors of the Paragon Manager do not accept any responsibility for any information relating to TPPL or any opinion expressed by TPPL.

Forward-Looking Statements

All statements other than statements of historical facts included in this FAQ are or may be forward-looking statements. Forward-looking statements include but are not limited to those using words such as “seek”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “project”, “plan”, “strategy”, “forecast” and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “may” and “might”. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from similar developments, shifts in expected levels of occupancy or property rental income, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in amounts and on terms necessary to support future business. You are cautioned not to place undue reliance on these forwardlooking statements, which are based on the TPPL’s and the Paragon Manager’s current view of future events, and neither TPPL nor the Paragon Manager undertakes any obligation to update publicly or revise any forward looking statements

The value of the Units and the income derived from them, if any, may fall or rise. Units are not obligations of, deposits in, or guaranteed by, TPPL, the Paragon Manager or any of their affiliates. An investment in Units is subject to investment risks, including the possible loss of the principal amount invested.

Investors should note that they have no right to request TPPL or the Paragon Manager to redeem or purchase their Units while the Units are listed. It is intended that Unitholders may only deal in their Units through trading on SGX-ST. Listing of the Units on the SGX-ST does not guarantee a liquid market for the Units.

This FAQ is for information only and does not constitute an invitation or offer to acquire, purchase or subscribe for the Units. The past performance of PARAGON REIT is not necessarily indicative of the future performance of PARAGON REIT.